Ledgers, the accounting basis, are as old as writing and money.

Their medium was clay, wooden tally sticks (that was a fire danger), stone, papyrus, and paper. Once computers were normalized in the 1980s and 1990s, paper records were digitized, often by manual data entry.

These early digital ledgers mimicked the paper-based world’s cataloging and accounting, and it could be said that digitization was applied more to paper document logistics than to their development. Paper-based organizations stay our society’s cornerstone: cash, seals, written signatures, bills, certificates, and the use of double-entry bookkeeping.

Computing power and breakthroughs in cryptography, along with the discovery and use of some fresh and exciting algorithms, have enabled distributed ledgers to be created.

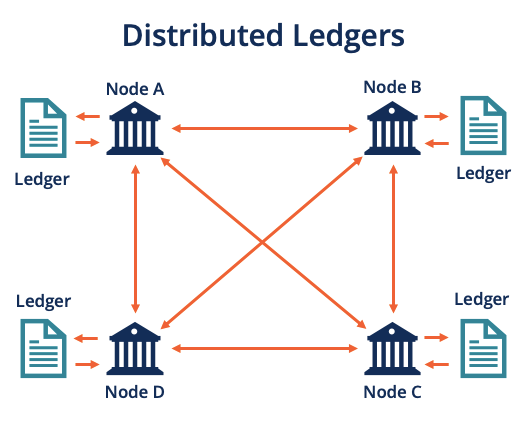

A distributed directory in its easiest form is a database maintained and updated separately by each person (or node) in a big network. The allocation is unique: documents are not conveyed by a central agency to different nodes but are instead built and kept separately by each node. That is, every single node on the network processes each transaction, reaching its own conclusions and then voting on those findings to make sure that the majority agrees with the findings.

Once this agreement has been reached, the distributed ledger has been updated and all nodes keep their own identical copy of the ledger. This architecture enables for fresh dexterity as a recording scheme that goes beyond being a straightforward database.

Distributed Ledgers are a vibrant type of media and have characteristics and capacities that go far beyond static ledgers based on paper. The brief version is that they allow us to formalize and save fresh types of interactions in the digital globe.

The gist of these fresh types of interactions is that the price of confidence (hitherto supplied by notaries, attorneys, banks, regulatory compliance officers, governments, etc.) is prevented by the architecture and characteristics of distributed ledgers.

The invention of distributed ledgers reflects a revolution in how data is collected and conveyed. It refers both to static information (a registry) and to dynamic data (transactions). Distributed ledgers enable users to proceed beyond easy database custody and direct energy to how we use, manipulate, and extract value from databases— less about keeping a database, and more about controlling a recording system.